Want to keep your Venmo activity private? While Venmo is a handy tool for money transfers, its default settings and design can expose personal details. Here’s how you can use Venmo while protecting your identity:

- Create a private account: Use a unique username, a new email address (via ProtonMail or similar), and avoid personal photos or real names.

- Use disposable phone numbers: Services like MobileSMS.io help you verify your account without revealing your real number.

- Set transactions to private: Adjust your Venmo privacy settings to ensure only you and the other party can see your activity.

- Avoid personal details in payment notes: Keep payment descriptions generic to prevent revealing your identity.

- Disable contact syncing: Stop Venmo from linking your account to your phone contacts or Facebook friends.

- Secure your account: Use strong passwords, fake security question answers, and two-factor authentication (preferably via an authenticator app).

Setting Up a Private Venmo Account

Keeping your Venmo account private takes some careful planning, but it’s entirely doable. The goal is to share only the bare minimum of personal information while still meeting Venmo’s requirements. This approach helps you stay anonymous and protects your identity while using the platform.

Creating an Account with Limited Personal Details

Start by picking a unique username that doesn’t tie back to your real identity. Skip obvious choices like "john_smith_2025" or "musiclover_sarah." Instead, go with something random and neutral, like "skyline_42" or "bridge_wanderer." These kinds of usernames keep your identity under wraps.

Next, use a dedicated email address for your Venmo account. Don’t use your main personal or work email. Instead, create a new one through a privacy-focused service like ProtonMail or Tutanota. Make sure the email address doesn’t include your name or other personal details.

For your profile picture, avoid using personal photos. Venmo doesn’t require one, so leaving it blank is the safest choice. If you want a visual element, pick something generic, like a landscape, an abstract design, or a simple icon that has no connection to your personal life.

When Venmo asks for a name, you don’t have to use your real one. Stick to initials or a made-up name, like "A. Johnson" or "Sam Lee." Keep it simple and non-identifiable, especially since this name might be visible to others depending on your privacy settings.

After setting up your profile, you can further protect your anonymity by using a disposable phone number for verification.

Using Disposable SIM-Based Phone Numbers for Verification

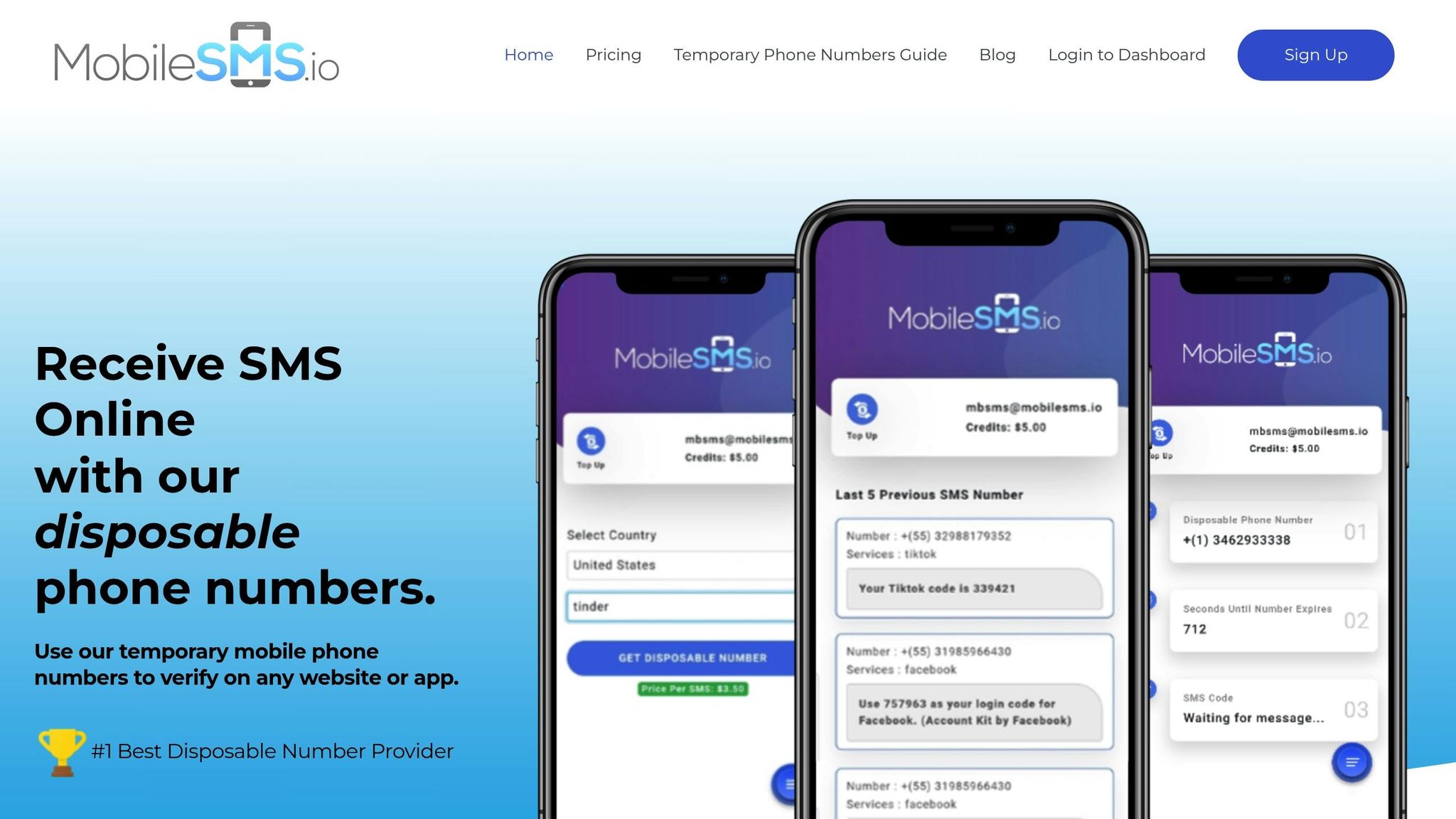

Venmo’s phone verification process can make staying anonymous tricky, but disposable SIM-based phone numbers are a great solution. Unlike free online SMS services, which often don’t work with financial platforms, real SIM-based numbers from services like MobileSMS.io are much more reliable.

Here’s how it works: When you sign up, you’ll enter the disposable number. Venmo will send a verification code via SMS, which you can access through the service’s dashboard. Enter the code to complete your account setup. The process is quick, and these numbers have a high success rate with platforms like Venmo.

These disposable numbers are typically available on a pay-per-success basis. Using one not only keeps your personal phone number private but also prevents spam or promotional messages from cluttering your personal device.

Choosing Strong Passwords and Security Questions

A strong, unique password is essential for keeping your account secure. Aim for at least 12 characters, mixing uppercase and lowercase letters, numbers, and symbols. Avoid using anything personal, like birthdays or family names, that could make your account vulnerable.

To make things easier, consider using a password manager like Bitwarden or 1Password. These tools can generate and store random, complex passwords, ensuring your account stays secure without requiring you to remember every detail.

When it comes to security questions, don’t use real answers. Instead, come up with fictional responses that are easy for you to recall or securely store. For example, if asked about your first pet’s name, you could use something unrelated like "Telescope" or "Marble." The same goes for questions about your first car, favorite teacher, or childhood street – make up believable but false answers.

Lastly, enable two-factor authentication (2FA) for an added layer of security. Since you’re using a disposable phone number, SMS-based 2FA might not be the best long-term option. Instead, use an authenticator app like Google Authenticator or Authy. These apps don’t rely on your phone number and provide continuous protection for your account.

Configuring Venmo Privacy and Security Settings

Once you’ve set up your Venmo account, it’s important to adjust its privacy settings. By default, Venmo shares more information than most users realize, so taking a few minutes to tighten these settings can go a long way in protecting your personal data and transactions.

Setting Transactions to Private

Did you know Venmo’s default setting makes your transactions visible to the public? This means anyone can see your payment activity, which isn’t ideal for privacy.

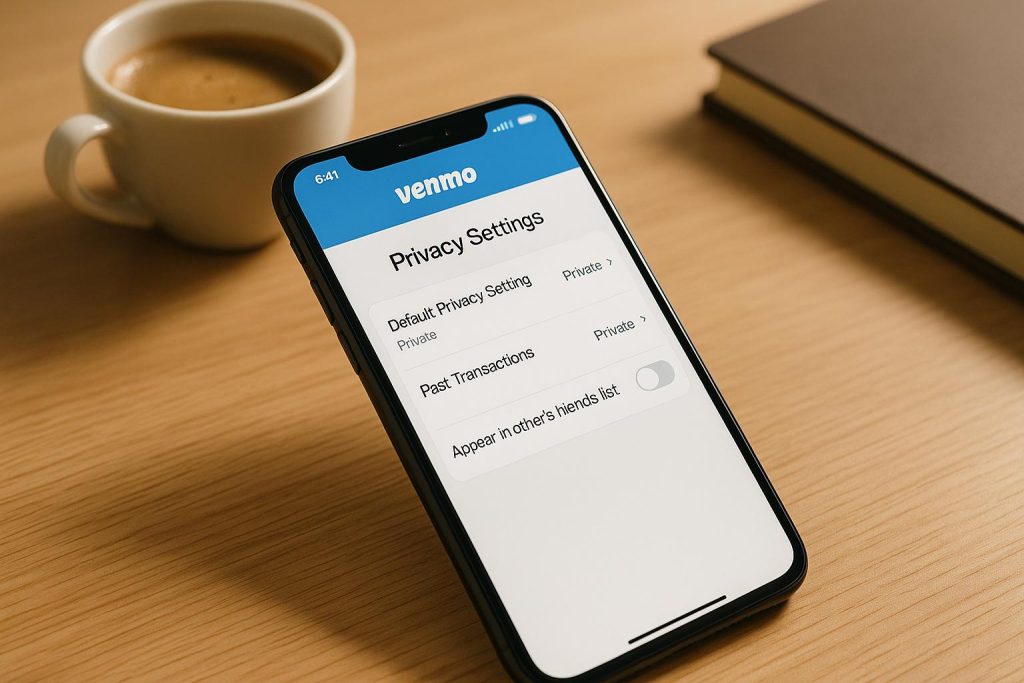

To fix this, open the Venmo app, tap the three horizontal lines in the top-left corner, and go to Settings. From there, select Privacy. You’ll find three visibility options for your transactions: Public, Friends, or Private. Choose Private to ensure that only you and the person you’re paying or receiving money from can view the transaction.

Keep in mind, this change only affects future transactions. If you’d like to make past transactions private, you’ll need to update those individually. While these settings keep your activity hidden from other users, Venmo still retains access to your transaction data for compliance and operational purposes.

Disabling Contact Sync and Public Sharing

Venmo automatically syncs your phone’s contact list to help you find friends, but this feature can also link your account to people you’d rather not connect with. To limit this, head to Settings in the app and navigate to the Privacy section. Under Friends List, set it to Private. Also, turn off the option to "Appear in other users’ friends lists." These steps make it harder for others to find your account through mutual contacts.

Managing App Permissions and Notifications

App permissions play a critical role in safeguarding your privacy. Venmo requests several permissions that, if left unchecked, could expose more than you’d like. Here’s how to manage them:

- Location Access: Disable location permissions in your device settings to prevent Venmo from tracking your movements.

- SMS Access: Venmo requires SMS access for initial verification, but you can turn off SMS notifications afterward to reduce unnecessary exposure.

- Photo and File Access: Only grant access when updating your profile picture, and consider revoking it once you’re done.

- Push Notifications: Transaction details can show up on your lock screen through push notifications. To avoid this, limit notifications to essential alerts like security updates, or disable them entirely.

Make it a habit to review your privacy settings regularly, especially after app updates, as permissions may change or reset without notice. These small adjustments can make a big difference in keeping your Venmo account secure.

Making Anonymous Transactions on Venmo

Even with strict privacy settings, staying truly anonymous on Venmo requires extra care to ensure your transaction details don’t inadvertently give away personal information.

Keeping Payment Notes Generic

Payment notes can unintentionally reveal your identity. Avoid including names, locations, or specific events. For example, instead of writing something like "Thanks for dinner, Sarah!" opt for something vague, like "dinner." It’s also a good idea to ask others sending you payments to avoid using your real name in notes.

Now, let’s talk about how to protect your identity when you’re on the receiving end of a payment.

Safeguarding Your Identity When Receiving Payments

To keep your personal details separate from your Venmo activity, only share the contact information tied to your anonymous account. Provide senders with the email or phone number associated with this account, rather than any personal details. This simple step ensures that your identity stays private while maintaining a secure transaction process.

sbb-itb-5a89343

Long-Term Privacy Maintenance on Venmo

Once you’ve set up your Venmo account with privacy in mind, keeping it secure over the long haul requires consistent effort and the right tools to protect your anonymity.

Using MobileSMS.io for Multi-Account Privacy

If you’re managing multiple Venmo accounts or need ongoing privacy, MobileSMS.io can be a game-changer. They provide long-term rental options for real SIM-based phone numbers, which are far more reliable than VoIP alternatives. These numbers are exclusively yours, ensuring a stable and anonymous connection for your Venmo accounts.

Why does this matter? Real SIM-based numbers have a 99.7% acceptance rate on platforms like Venmo, making them a dependable solution for account verification. Plus, MobileSMS.io operates on a pay-per-success model, so you’re only charged when a verification code is successfully received. Even better, your credits stay valid for 12 months, giving you flexibility.

By using these numbers, you can maintain privacy over time and stay ahead of any potential account verification issues.

Regularly Reviewing Privacy Settings

Venmo frequently updates its app and privacy policies, so it’s a good idea to check your settings regularly to ensure your account stays secure.

- Make sure your transaction visibility is set to "Private" at all times.

- Review app permissions and notification settings, especially after updates, to block any new features that might compromise your anonymity.

- Keep your Venmo activity separate from your primary online identity by avoiding unnecessary app integrations.

These routine checks can help you catch any changes that might expose your information.

Reducing Your Digital Footprint Beyond Venmo

Maintaining privacy on Venmo is only part of the equation – you’ll also want to minimize your overall digital footprint to protect your identity.

- Avoid linking your anonymous Venmo account to budgeting or financial apps that might cross-reference your data.

- Use a unique email address and phone number for your Venmo account, separate from those tied to your other online activities.

- Consider funding your Venmo account with prepaid cards purchased with cash. This adds an extra layer of separation between your real identity and your transactions.

To further safeguard your anonymity, periodically use privacy-focused search engines to check whether any of your anonymous usernames, email addresses, or other details have been linked to your actual identity. Staying proactive about your digital presence is key to maintaining long-term privacy.

Conclusion: Key Steps for Anonymous Venmo Usage

Staying anonymous on Venmo requires a mix of smart tools and consistent privacy habits. Start by creating your account with real SIM-based phone numbers from MobileSMS.io, which offer a 99.7% success rate for Venmo’s verification process.

Next, take control of your privacy settings. Head to the Me tab, navigate to Settings > Privacy, and set your default transaction privacy to "Private." Don’t forget to update all past transactions to private as well. Since Venmo’s default setting is "Public", failing to adjust these options could leave your financial activity exposed, increasing your digital footprint and potential cybersecurity risks. Think of these settings as your first layer of protection.

From there, pay attention to the finer details. Use prepaid debit cards bought with cash to fund your account, avoid adding personal details in payment notes, and make sure your friends list is completely private. These steps help you keep your identity separate from your transactions.

Lastly, staying anonymous isn’t a one-and-done effort. Privacy settings can change with app updates, so it’s important to regularly review and adjust them. By sticking to these habits, you can keep your Venmo activity private over the long haul.

FAQs

How can I make sure my Venmo transactions stay private?

To keep your Venmo transactions out of public view, make sure to set your default privacy setting to Private. Here’s how: Open the app, head to the Me tab, tap the Settings gear icon, select Privacy, and then choose Private as the default for all transactions. This ensures that your activity stays hidden from others.

You can also update the privacy settings for past transactions. Go back to the Privacy section and switch previous transactions to Private. These simple steps can help protect your payment history and ensure your personal information stays secure on Venmo.

How can I make my existing Venmo account more private and anonymous?

To keep your Venmo account more secure, start by adjusting your payment privacy settings to ‘Private’ for both past and future transactions. Here’s how: open the Venmo app, navigate to the Me tab, tap Settings, then Privacy, and choose ‘Private’. This way, only you and the recipient can see your transactions.

You should also set your default privacy setting to ‘Private’ so that all future payments are automatically hidden. To further safeguard your account, review your profile and minimize the personal information you share. These steps can go a long way in protecting your privacy on the platform.

Are there any risks to using a disposable phone number for Venmo verification?

Using a disposable phone number for Venmo verification might seem convenient, but it comes with some risks you should be aware of. For instance, if Venmo flags suspicious activity on your account, they could lock it. Recovering access in such cases could be tricky if you no longer have access to the disposable number. Plus, these numbers are often shared or recycled, making them more vulnerable to scams or fraud.

To reduce these risks, choose a trustworthy disposable number provider and stick to Venmo’s guidelines to avoid raising any red flags with their security system.