Verifying Indian apps like PhonePe or Paytm from outside India can be a frustrating process due to issues with SMS verification and OTP delivery. These apps rely on SMS-based OTPs sent to Indian numbers, which often fail to reach international users due to carrier blocks, lack of roaming, or inactive SIMs. While some banks now allow linking international numbers, the process is slow, limited to 12 countries, and requires an NRE/NRO account.

Key Takeaways:

- PhonePe/Paytm Official Method: Requires an NRE/NRO account, linking your international number with the bank, and using the India-region app. OTP delivery is unreliable due to carrier blocks.

- MobileSMS.io Alternative: Offers real Indian SIM-based numbers for OTPs, bypassing carrier issues. Setup is instant, no bank account is needed, and privacy is maintained. Costs start at $3.50 per OTP.

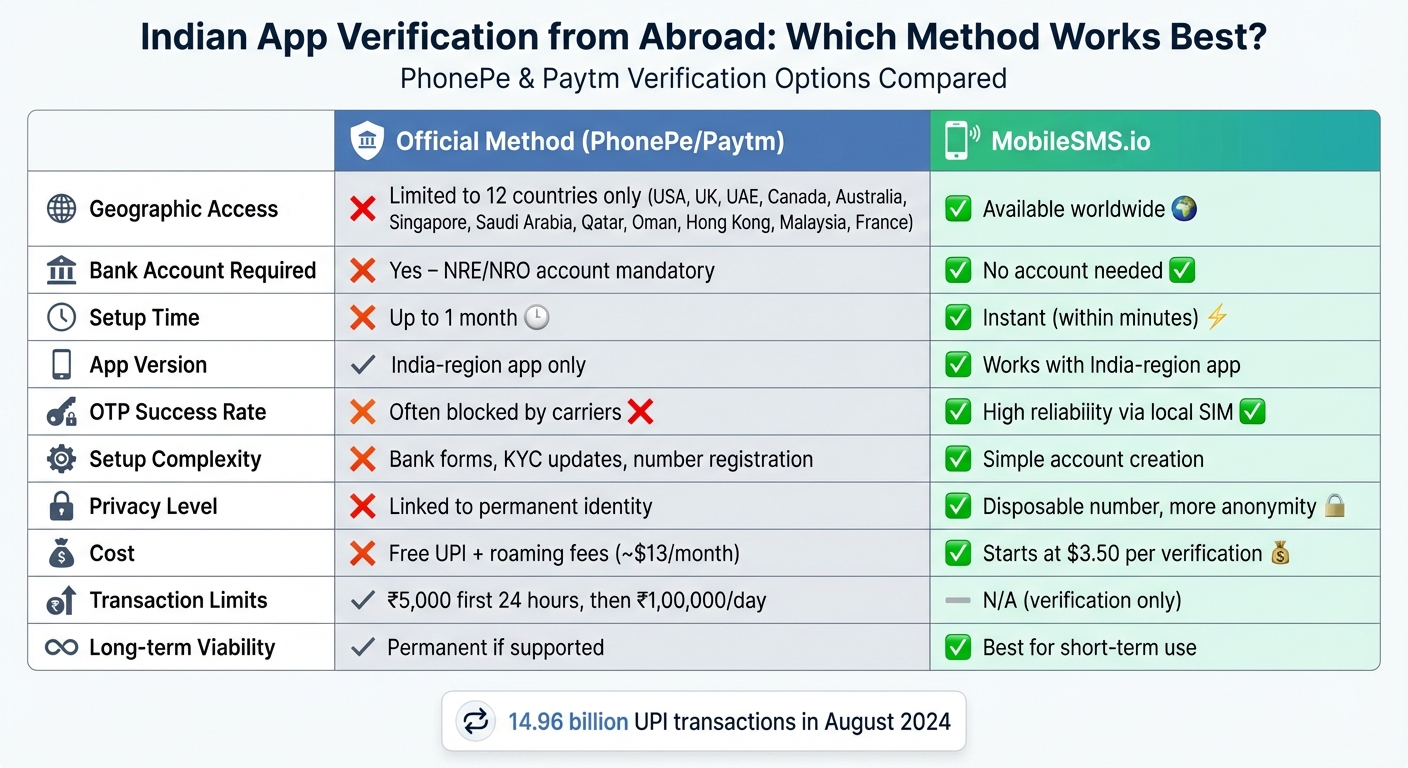

Quick Comparison:

| Feature | Official Method (PhonePe/Paytm) | MobileSMS.io |

|---|---|---|

| Eligibility | Limited to 12 countries | Available globally |

| Bank Account Required | NRE/NRO account needed | Not required |

| Setup Time | Days to weeks | Minutes |

| OTP Success Rate | Often blocked | Highly reliable |

| Cost | Free (with roaming fees) | $3.50 per OTP |

For those struggling with OTPs while abroad, MobileSMS.io provides a fast and reliable solution, avoiding the complexities of official methods.

PhonePe and Paytm Verification: Official Method vs MobileSMS.io Comparison

PhonePe Verification: Official Process vs. MobileSMS.io

PhonePe’s Official Verification for International Users

PhonePe’s official verification process for international users comes with strict requirements. You’ll need an NRE or NRO account with a participating Indian bank, and this feature is limited to users from 12 countries: the USA, UK, UAE, Canada, Australia, Singapore, Saudi Arabia, Qatar, Oman, Hong Kong, Malaysia, and France.

Before starting, you must ensure your international number is registered as the primary contact in your bank’s records. This isn’t automatic – you’ll need to update it manually via net banking or submit a written request. While major banks like SBI, HDFC, ICICI, and Axis support this feature, the exact process can vary. Additionally, you’ll need your NRE/NRO debit card details (last 6 digits and expiry date) to set up your UPI PIN.

However, international SMS delivery can be a major hurdle. Many carriers block OTPs from Indian short codes as part of fraud prevention measures. Even if your bank has updated your number, verification messages might not arrive due to carrier routing issues or "Bad Gateway" errors. On top of that, new UPI IDs created with international numbers face restrictions: a $60 (₹5,000) transaction cap for the first 24 hours and a daily limit of $1,200 (₹1,00,000) thereafter.

For those looking for a faster, simpler solution, MobileSMS.io offers an alternative.

Using MobileSMS.io for PhonePe Verification

MobileSMS.io simplifies the process by providing real SIM-based Indian numbers instead of virtual or VoIP numbers, which PhonePe’s security systems often block. These real SIM numbers operate on Indian infrastructure, ensuring reliable SMS delivery without the complications of international carrier issues.

Setup is quick and hassle-free, with no need to update bank records or deal with country-specific restrictions. MobileSMS.io numbers work globally and offer a 99.7% success rate for platform acceptance. Additionally, your privacy is safeguarded since your personal international number isn’t linked to the app – protecting you from potential data leaks or unwanted marketing.

Pricing starts at $3.50 per SMS, with rental plans available for extended use. Options range from $15 for 7 days to $100 for 90 days, including unlimited SMS for one platform. For those managing multiple accounts or team workflows, the Premium All Services plan at $100/month includes automatic SMS forwarding and Slack/Discord integration.

Comparison Table: Official Method vs. MobileSMS.io

Here’s a side-by-side look at the two methods:

| Feature | PhonePe Official Method | MobileSMS.io |

|---|---|---|

| Eligibility | NRE/NRO account holders in 12 approved countries | Available globally for anyone |

| Setup Time | Several days to update bank records | Instant (within minutes) |

| SMS Reliability | Often blocked by international carriers | High success rate via real SIM routing |

| Privacy | Links to your personal number | Keeps your personal number private |

| Account Requirement | Requires an NRE/NRO account | No Indian bank account needed |

| Cost | Free (may incur roaming SMS fees) | Starting at $3.50 per verification |

| Number Type | Your international mobile number | Real Indian SIM-based number |

sbb-itb-5a89343

Paytm Verification: Official Process vs. MobileSMS.io

Paytm’s Official Verification for International Users

If you’re an international user looking to verify your Paytm account, the official route involves linking your number to an NRE/NRO account with a participating Indian bank. You’ll also need to use the international number registered with your bank. While this process is thorough, it often takes several days to complete using net banking.

Currently, this service is available in only 12 countries: the USA, UK, UAE, Canada, Australia, Singapore, Hong Kong, Saudi Arabia, Qatar, Oman, Malaysia, and France. To proceed, you must install the India-region version of the Paytm app, as international app store versions won’t support linking to an Indian bank account.

The verification process hinges on receiving an SMS to confirm your number is linked to the bank. However, this step can be a major hurdle. International carriers frequently block OTPs sent from Indian short codes as part of their fraud prevention measures. Even if your bank registration is correct, these blocks can prevent the OTP from being delivered. Once verified, your transactions will still be subject to limits set by Indian regulations.

"Enabling NRIs to use Paytm UPI with their international mobile numbers is another step in that journey. It keeps Indians connected to India’s growing mobile payments ecosystem, no matter where they live." – Paytm Spokesperson

These complications often leave users searching for a more straightforward solution.

Using MobileSMS.io for Paytm Verification

Just like with PhonePe, Paytm users abroad face challenges with OTP delivery. That’s where MobileSMS.io steps in, offering a hassle-free alternative. By providing real SIM-based Indian numbers, this service ensures global accessibility without requiring an NRE/NRO account, bank updates, or worrying about your country being on a restricted list.

The setup is quick and seamless. Within minutes, you can receive OTPs through an Indian number that operates on local infrastructure. This approach avoids the international carrier blocks entirely, delivering the SMS directly to the Indian SIM. Plus, it keeps your personal international number completely private.

Pricing starts at $3.50 per OTP, with rental plans ranging from $15 for 7 days to $100 for 90 days. For those seeking additional features, the Premium All Services plan costs $100/month and includes automatic SMS forwarding and Slack/Discord integration. MobileSMS.io aims to make Indian app verification simple and accessible for users around the world.

Comparison Table: Official Method vs. MobileSMS.io

| Feature | Paytm Official Method | MobileSMS.io |

|---|---|---|

| Country Availability | Limited to 12 approved countries | Available globally |

| Bank Account Required | Must have an NRE/NRO account | No Indian bank account needed |

| Setup Time | Several days to link number with bank | Instant (within minutes) |

| SMS Reliability | Frequently blocked by international carriers | High success rate via real Indian SIM |

| Privacy Protection | Links to your permanent personal number | Keeps your personal number private |

| App Version | Must download the India-region app version | Works with any app version |

| Cost | Free (may incur roaming fees) | Starting at $3.50 per verification |

| Number Type | Your international mobile number | Real Indian SIM-based number |

Side-by-Side Comparison: Official Methods vs. MobileSMS.io

When it comes to verifying PhonePe or Paytm from abroad, official methods come with a laundry list of hurdles. They’re limited to just 12 countries, require an NRE/NRO bank account tied to your international number, and the registration process can drag on for up to a month due to incomplete implementation of NPCI guidelines.

On top of that, you’re stuck using the India-region version of the apps, which often involves changing your App Store region. And even then, OTP delivery can be hit or miss because international carriers frequently block Indian short codes.

Enter MobileSMS.io – a solution that skips all the red tape. It offers instant, worldwide access to authentic Indian SIM-based numbers. These numbers reliably receive OTPs through local infrastructure, safeguard your privacy, and eliminate the need for pricey roaming charges, which can reach around ₹1,100 ($13) per month.

Here’s a side-by-side look at how these methods stack up:

Comparison Table: PhonePe and Paytm Verification Options

| Feature | Official Method (PhonePe/Paytm) | MobileSMS.io |

|---|---|---|

| Geographic Access | Limited to 12 countries only | Available worldwide |

| Bank Account Type | Requires NRE/NRO account | No account needed |

| Registration Time | Up to 1 month | Instant (within minutes) |

| App Version Required | India-region app only | Works with India-region app |

| OTP Success Rate | Often blocked by carriers | High reliability via local SIM |

| Setup Complexity | Bank forms, KYC updates | Simple account creation |

| Privacy Level | Linked to permanent identity | Disposable number, more anonymity |

| Ongoing Costs | Free UPI + roaming fees ($13/month) | Starts at $3.50 per verification |

| Transaction Limits | ₹5,000 first 24 hours, then ₹100,000/day | N/A (verification only) |

| Long-term Viability | Permanent if supported | Best for short-term use |

The numbers speak for themselves. In August 2024 alone, UPI facilitated over 14.96 billion transactions, proving just how vital these apps are for staying connected to India’s payment network. Yet, the restrictive nature of official methods leaves countless users scrambling for alternatives. MobileSMS.io offers a practical, hassle-free way to bridge the gap, especially for those who need quick and reliable verification without the usual headaches.

Conclusion: Why MobileSMS.io Works Best for Indian App Verification Abroad

Verifying apps like PhonePe or Paytm from outside India can feel like jumping through hoops. The official process is riddled with limitations – you’re restricted to just 12 approved countries, need to open an NRE or NRO account, and often end up waiting as banks like SBI and HDFC slowly expand support for international numbers. For many, it’s simply not practical.

That’s where MobileSMS.io steps in. This service offers instant access to Indian SIM-based numbers, skipping the need for special accounts or regional restrictions. By using disposable numbers, it keeps your personal information private, so you don’t have to risk exposing your primary contact details. And with one-time verifications starting at just $3.50, it’s a budget-friendly solution compared to the hassle of maintaining a physical SIM card for international roaming.

If you’re in a country outside the official support list or struggling with bank compatibility issues, MobileSMS.io provides a simple and efficient alternative. Instead of waiting for banks to update their systems or dealing with app glitches, you can verify your account in just a few minutes. It’s a straightforward, reliable way to stay connected to India’s digital payment platforms without unnecessary complications.

FAQs

Why don’t OTPs from Indian apps work on international phone numbers?

International carriers sometimes block OTP (One-Time Password) messages from Indian apps due to concerns about fraud risks and cross-border SMS regulations. These messages are often flagged as high-risk when sent internationally, as part of efforts to tighten security and ensure compliance. On top of that, many countries are moving away from SMS-based authentication in favor of more secure alternatives, which can make delivering OTPs to non-Indian numbers even more difficult.

If you’re outside India and need to verify an Indian app, this can create hurdles. A dependable way to receive OTPs on an Indian number can help you work around these restrictions and maintain smooth access to the services you rely on.

How does MobileSMS.io ensure seamless OTP delivery for Indian apps like PhonePe and Paytm?

MobileSMS.io provides real Indian +91 disposable numbers to guarantee seamless and secure OTP delivery. These numbers are designed to instantly receive verification codes through reliable, carrier-grade routing. Whether you’re using apps like PhonePe or Paytm, this service ensures quick and hassle-free user verification, no matter where you are globally.

What are the advantages and costs of using MobileSMS.io for verifying Indian apps like PhonePe or Paytm from the U.S.?

MobileSMS.io provides temporary +91 Indian phone numbers specifically designed to receive OTPs for apps like PhonePe, Paytm, and other Indian platforms. With this service, there’s no need to get a physical Indian SIM card, making it a hassle-free solution for account verification.

Some standout perks include:

- Privacy protection: Keep your personal number safe and avoid spam or potential data breaches.

- Instant verification: These disposable numbers work immediately, streamlining the process.

- 24/7 availability: Verify accounts anytime, even if you’re in the U.S.

Pricing is flexible, tailored to your needs. You can choose a single-use number for just a few dollars or opt for subscription plans if you require frequent verifications. Plus, since these numbers are active for only 10 minutes, you save on ongoing fees tied to maintaining a permanent Indian SIM card while effortlessly meeting your verification needs.