You can use Cash App without linking your personal phone number by using a secure, non-personal number such as a real SIM-based disposable number. This approach helps protect your privacy, reduces spam risks, and ensures your personal data is not exposed. Services like MobileSMS.io provide U.S.-based numbers that meet Cash App’s verification requirements, allowing you to create an account while maintaining anonymity. Here’s how:

- Why Avoid Using Your Personal Number? Linking your personal phone number to Cash App can expose your data, leading to spam or security risks.

- The Solution: Use a non-VoIP, SIM-based disposable number from providers like MobileSMS.io.

- How It Works: MobileSMS.io supplies real carrier-issued numbers for account verification. Simply rent a number, enter it during Cash App registration, and retrieve the SMS code to complete setup.

- Privacy Tips: Use a separate email, a pseudonymous $Cashtag, and avoid sharing personal details on your profile.

While unverified accounts have limits (e.g., $1,000–$1,500 transaction caps), they allow for anonymous transactions. Verified accounts require more personal information but unlock additional features like higher limits and Cash App Cards. Always follow Cash App’s terms and maintain consistent account activity to avoid flags.

Key Takeaway: Using a disposable number keeps your personal data secure while enabling safe, anonymous payments on Cash App.

Cash App Verification and Privacy Requirements

Cash App employs several layers of verification to safeguard accounts and enable higher transaction limits, which depend on the personal information users provide.

Why Does Cash App Need a Phone Number?

To confirm user identities and protect access to sensitive features, Cash App requires phone number verification. This must be a U.S.-based number capable of receiving texts or calls – VoIP numbers like Google Voice or Skype are not accepted. Without completing this step, users face restrictions on key features such as sending or receiving amounts over $1,000–$1,500, obtaining a Cash App Card, or engaging in investment activities.

Privacy Concerns with Personal Phone Numbers

Linking your personal phone number to your Cash App account connects your contact information to your financial transactions. This has raised privacy concerns for some users, prompting them to explore alternative ways to maintain anonymity while using the app.

Can You Use Cash App Anonymously?

Cash App does provide some level of anonymity through unverified accounts. These accounts allow users to send and receive up to $1,000–$1,500 within certain timeframes. They display only your $Cashtag and display name, keeping other details hidden. However, unverified accounts come with limitations – they can’t access features like Cash App Cards or investment tools. Additionally, since a U.S.-based phone number is required, any alternative verification method must comply with this rule. By understanding these restrictions, you can better manage your financial transactions while addressing your privacy concerns.

How to Create a Cash App Account Without Your Personal Phone Number

If you’re looking to set up a Cash App account without sharing your personal phone number, the key lies in using non-VoIP numbers that meet the platform’s verification requirements. This involves getting a real SIM-based number and carefully following steps to protect your privacy during the process.

Why Non-VoIP Numbers Are Necessary

Cash App has strict verification rules and blocks VoIP numbers because they’re easily disposable and less secure. Instead, the platform requires a carrier-issued phone number tied to a physical SIM card. These numbers are more reliable for receiving SMS messages through traditional networks, making them a safer choice for account verification.

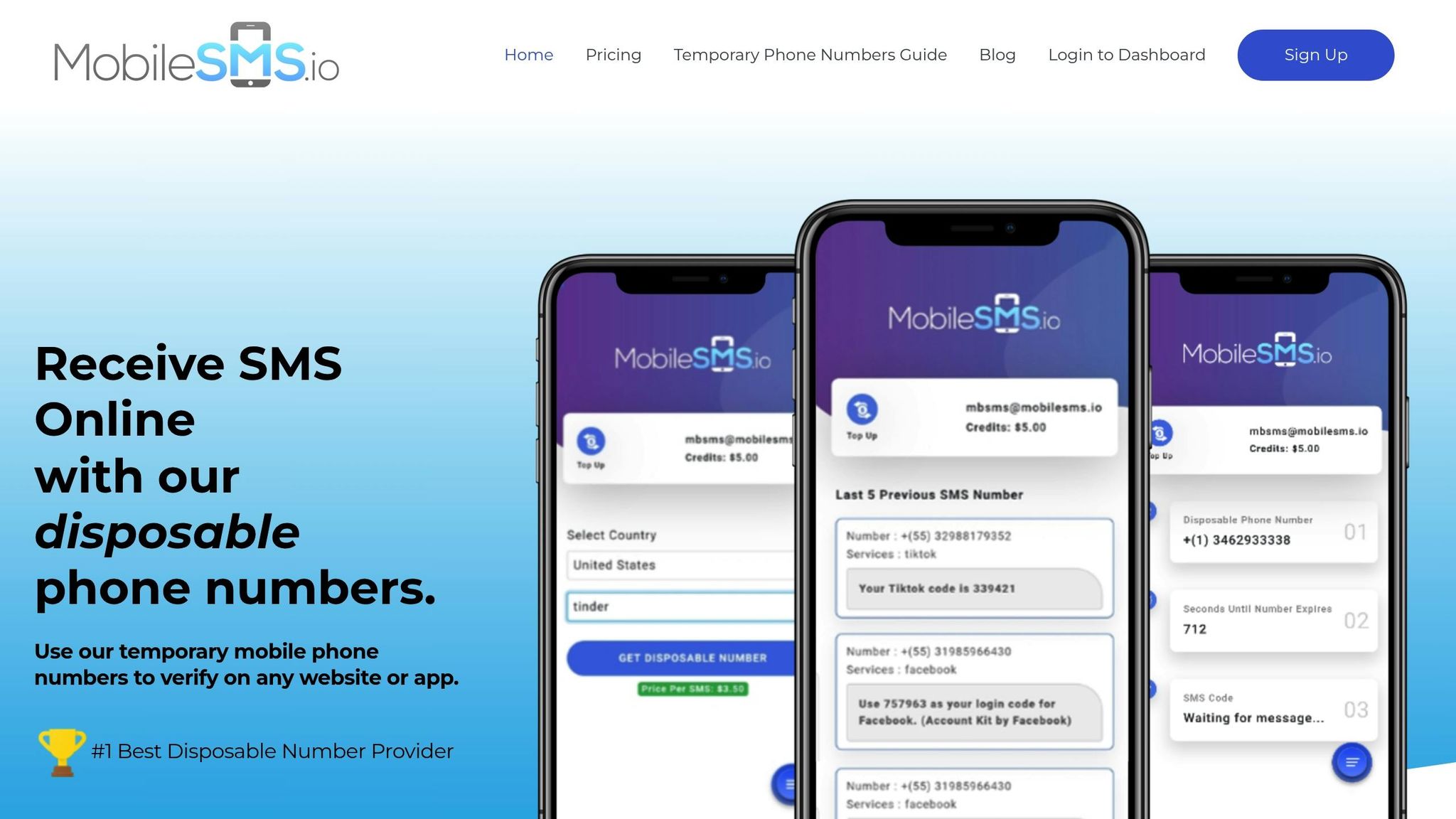

How to Use MobileSMS.io for Registration

MobileSMS.io provides real SIM-based disposable numbers specifically for services like Cash App. Here’s how you can use it to register:

- Sign up on MobileSMS.io and deposit a minimum of $5.00. Your credits will remain valid for up to 12 months.

- Choose a U.S.-based disposable number from their available options.

- Enter the selected number into Cash App during the registration process.

- Retrieve the SMS verification code from your MobileSMS.io dashboard.

- Input the code into Cash App to complete the account setup.

The entire process is quick and takes just a few minutes. MobileSMS.io also uses a pay-per-success model, meaning you’re only charged if the verification code is successfully received.

Privacy Tips for Extra Protection

To keep your identity secure while creating and using your Cash App account, consider these precautions:

- Use a separate email address for Cash App, preferably from a privacy-focused provider like ProtonMail or Tutanota.

- Pick a $Cashtag that doesn’t include your real name or any identifying information.

- Connect to public Wi-Fi or use a VPN to mask your IP address and location.

- Avoid adding personal details to your display name or profile.

- When linking a payment method, opt for prepaid cards or gift cards instead of using your personal bank account or debit card.

- Store your login credentials, $Cashtag, and associated email securely in a password manager to avoid losing access to your account later.

Why Choose MobileSMS.io for Secure SMS Verification

When it comes to secure and anonymous SMS verification, MobileSMS.io stands out as a trusted solution. It’s particularly effective for platforms like Cash App, where strict verification requirements can be a challenge.

MobileSMS.io Features

MobileSMS.io uses real SIM-card-based numbers from legitimate mobile carriers, not VoIP numbers. These numbers are reliable across more than 1,200 platforms and include U.S. options specifically designed for Cash App registration. Whether you need a single-use number or something longer-term, there’s a plan for you:

- One-time disposable numbers start at $3.50.

- Longer-term rentals range from $15 for 7 days to $100 for 90 days.

One of the standout features is the pay-per-success model – you only get charged if you receive the SMS verification code. With a 99.7% acceptance rate, this approach far outperforms VoIP numbers. For those prioritizing privacy, MobileSMS.io also accepts cryptocurrency payments, and credits remain valid for 12 months. Plus, every purchase is backed by a 7-day money-back guarantee. These features make the verification process seamless and secure.

How to Use MobileSMS.io for Cash App Verification

Getting verified with MobileSMS.io is quick and straightforward. Here’s how it works:

- Create an account and deposit a minimum of $5.00.

- Access the user-friendly dashboard to browse available U.S. phone numbers compatible with Cash App.

- Rent a number and enter it in Cash App’s registration form.

- Wait for the SMS verification code, which will appear in real time on the MobileSMS.io dashboard.

The temporary numbers remain active for about 10 minutes after receiving the code, ensuring your privacy while completing the process.

Benefits Over Other Phone Verification Methods

MobileSMS.io offers several advantages that make it a better choice than other verification methods, especially if anonymity is your goal. By using a disposable number for each verification, you keep your personal contact details safe from spam, data breaches, and marketing calls. Unlike VoIP numbers, which are often blocked by Cash App, MobileSMS.io’s carrier-based numbers consistently pass verification checks.

For users managing multiple accounts or needing ongoing access, the platform’s long-term rental options are a game-changer. These plans include automatic SMS forwarding and integration options, making them ideal for teams.

Cost-wise, a single successful Cash App registration costs between $3.50 and $5.50. This not only saves money but also eliminates the frustration of repeated verification failures. MobileSMS.io delivers a reliable and private solution for your SMS verification needs.

sbb-itb-5a89343

Best Practices for Maintaining Privacy and Avoiding Account Flags

Once your account is set up, it’s important to follow some key practices to protect your privacy and steer clear of account flags. Cash App keeps an eye out for unusual activity, so using your account in a natural and consistent way is crucial.

Strengthen Account Security

Keeping your account secure is the first step to maintaining privacy. Here’s how you can do that:

- Create a Strong Password: Use a unique password that combines uppercase and lowercase letters, numbers, and symbols. Store it safely in a reliable password manager.

- Enable Two-Factor Authentication (2FA): Add an extra layer of protection. If you use 2FA, make sure your MobileSMS.io number stays active to receive verification codes.

- Monitor Your Account: Regularly check your transactions and account alerts to spot any unauthorized activity.

- Secure Your Devices: Only access your account on devices and networks that are secure and up-to-date. If needed, use a trusted VPN to mask your IP address.

Avoid Common Mistakes

Even with strong security measures, some missteps can put your privacy at risk. Here’s what to avoid:

- Reusing Numbers: Dedicate your MobileSMS.io number solely to Cash App to prevent cross-platform connections.

- Email Practices: Use a separate, privacy-focused email address for each service to limit tracking across accounts.

- Transaction Habits: Start with smaller transactions and gradually increase them. Abrupt, high-volume activity can raise red flags.

- Personal Info on Profile: Keep your $Cashtag and profile free of personal details like your real name, photos, or location hints. Even casual mentions of your location can compromise your anonymity.

- Over-Linking Accounts: Don’t connect your Cash App account to social media, contacts, or other financial platforms unnecessarily.

Legal and Platform Policy Considerations

Staying compliant with legal and platform rules is just as important as protecting your account.

- Terms of Service Compliance: Cash App requires accurate personal information during registration. Using anonymous details could lead to account suspension or verification requests.

- Regulatory Limits: U.S. financial laws may require identity verification for transactions nearing certain thresholds. Be prepared for this if your activity appears unusual.

- Tax Responsibilities: You’re responsible for adhering to tax reporting rules for payment app transactions. Consulting a tax professional can help you stay compliant.

- State-Specific Rules: Money transmission laws differ by state and may impose extra requirements, especially for business-related transactions.

- Anti-Money Laundering Checks: Rapid or high-volume transactions can trigger account reviews. Stick to consistent, everyday usage patterns to avoid unnecessary scrutiny.

Conclusion

Setting up a Cash App account without linking your personal phone number is entirely possible when you use the right tools and strategies. This guide has walked you through methods to maintain privacy while adhering to Cash App’s verification requirements.

To summarize, maintaining privacy on Cash App involves a careful balance. You can shield your personal details from other users by using pseudonymous $Cashtags and avoiding the use of your real phone number. However, keep in mind that Cash App itself still retains transaction data and may require additional verification for higher spending limits. While unverified accounts come with restrictions, these are often sufficient for everyday use.

Using MobileSMS.io’s real SIM-card technology ensures a smooth verification process without triggering account flags or rejections. This service offers a reliable and secure alternative to free options, providing a safer way to protect your personal information during registration.

By choosing MobileSMS.io, you can minimize the risks associated with data breaches and unwanted tracking that often accompany linking personal phone numbers to financial platforms. For those needing ongoing access, their long-term rental options allow you to maintain verification without exposing your real contact details.

Staying vigilant is essential: use strong passwords, keep transaction patterns consistent, and avoid including personal information in your profile or payment notes. While Cash App itself cannot offer complete anonymity due to regulatory requirements, you can still take meaningful steps to reduce your digital footprint and protect your privacy from others.

In today’s world, prioritizing privacy in digital transactions is more important than ever. By incorporating services like MobileSMS.io and following the practices outlined here, you can enjoy the convenience of Cash App while keeping your personal information secure and minimizing exposure to privacy risks.

FAQs

Can I use a VoIP number to verify my Cash App account?

Cash App generally doesn’t allow the use of VoIP numbers – like those from Google Voice or Skype – for account verification. To successfully verify your account, you’ll need a valid U.S.-based mobile or landline number.

If privacy is a concern, consider using a non-VoIP or disposable phone number that meets Cash App’s requirements. Just ensure the number is active and able to receive SMS verification codes.

What are the risks of using a Cash App account without verification?

Using a Cash App account without verifying your identity has its drawbacks and risks. For starters, unverified accounts are limited to a $1,000 transaction cap every 30 days, which can be a hassle if you need to send or receive larger sums. On top of that, these accounts provide minimal protection against fraud, hacking, or disputes, making it tough to recover your money if something goes wrong.

Unverified accounts are also more prone to security vulnerabilities and don’t offer strong support for resolving issues. If you want a safer and more reliable experience, verifying your account is a smart move.

Does using a disposable phone number affect the security of my Cash App transactions?

Using a disposable phone number can be a smart way to protect your privacy, but it’s not without its risks. These temporary numbers might be easier to misuse or intercept if you’re not careful. For instance, if someone manages to access your disposable number, they could potentially jeopardize your Cash App account.

To stay on the safe side, stick to reliable services when choosing disposable numbers, and make sure your Cash App account is secured with features like two-factor authentication. While disposable numbers can offer an extra layer of anonymity, pairing them with solid security measures is key to keeping your transactions secure.